[ad_1]

VIX hit a brand new yearly low. S&P 500 hit a brand new yearly excessive. Taking part in for a pullback by shopping for places on SPY has by no means been cheaper over the previous 12 months.

We prefer to make use of a multi-faceted strategy to commerce thought era at POWR Choices. Combining basic, technical, and implied volatility (IV) evaluation to seek out an edge.

A fast stroll by means of of the method is highlighted our most up-to-date evaluation of the S&P 500 under. We are going to use each SPX and SPY interchangeably within the dialogue since many merchants possible commerce SPY versus SPX.

Valuations

At all times want taking a look at Worth/Gross sales versus the extra broadly adopted Worth/Earnings (P/E) ratio since earnings might be extra simply gamed by inventory buybacks and accounting methods. Worth/Gross sales is a cleaner quantity.

The latest run-up within the SPX wasn’t primarily based on torrid earnings or income development however was merely extra of a a number of growth.

By way of revenues, analysts have decreased their estimates through the upcoming quarter. As of Friday, the S&P 500 is predicted to report (year-over-year) income development of three.2%, in comparison with the expectations for income development of three.9% on September 30. So, slowing development on the horizon.

The present Worth/Gross sales (P/S) ratio within the S&P 500 is now again on the 2.5x stage and nearing the loftiest ranges up to now yr. It is usually greater than 1 customary deviation greater than the typical over the prior 12 months as nicely.

Certainly, the final time the S&P 500 traded at such a lofty a number of was late July which marked a major short-term high out there as seen within the chart.

Velocity

The SPY is beginning to lose upside momentum because it stalls out on the $4600 resistance stage. 9-day RSI bought to overbought ranges however has weakened. Bollinger P.c B approached 100 then softened. Extra importantly, MACD simply generated a promote sign by turning destructive even because the S&P 500 hit an annual excessive.

The earlier two instances this occurred coincided with a pointy pullback within the S&P 500 as highlighted within the chart above. See if the identical occurs as soon as once more.

VIX

The VIX made a brand new annual low on Friday, closing under the important thing 12.50 stage after hugging that worth stage for 2 weeks.

The earlier two instances it bought to such depressed readings after prolonged consolidation coincided exactly with tops within the SPX proven under. This may increasingly as soon as once more be an opportune time to take a short-term brief place within the S&P 500.

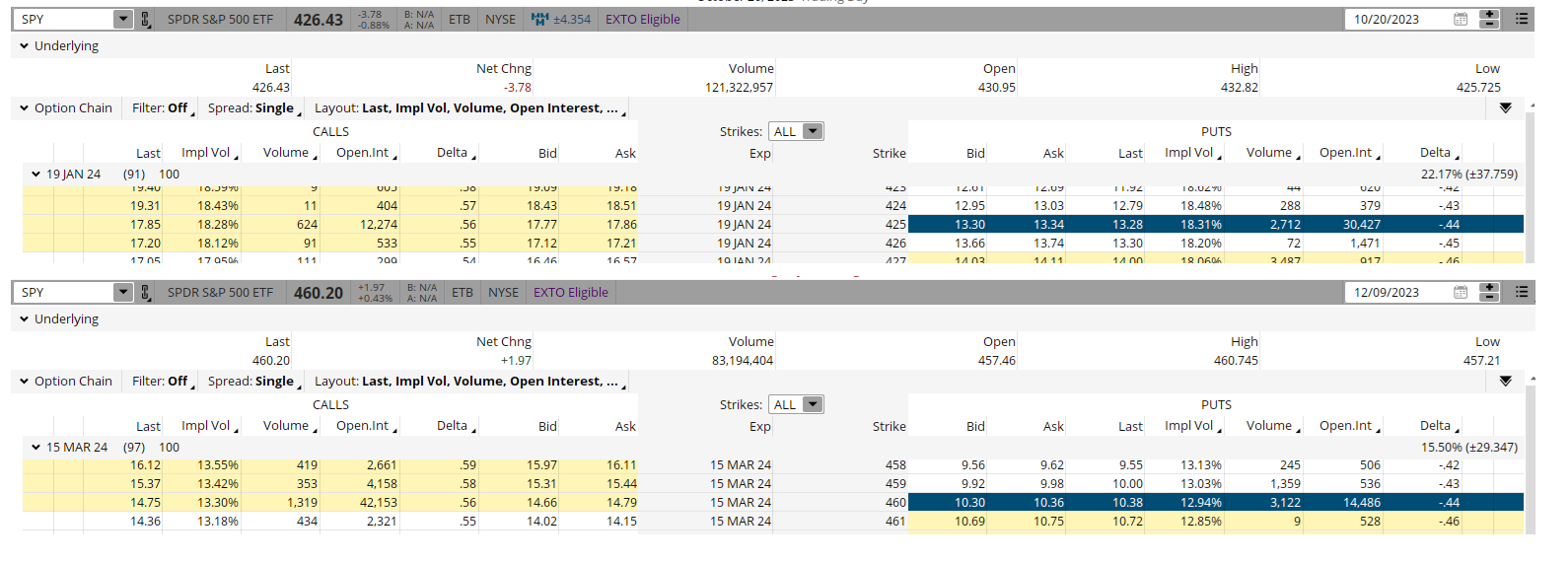

The brand new low ranges of VIX additionally imply choice costs are the most cost effective they’ve been in a yr. A comparability of put costs from October 20 (when S&P 500 was close to the lows) versus Friday’s shut with SPY at highs exhibits simply how less expensive.

On October 20, the SPY closed at $426.43. The marginally out-of-money $425 put ($1.43 out-of-the-money) was buying and selling at $13.32 and had 91 days to expiration (DTE). Implied volatility (IV) was over 18.

Friday exhibits that the SPY closed at $460.20. The at-the-money put (solely 20 cents out-of-the cash) was buying and selling at $10.33 and had 97 DTE. Implied volatility was just below 13.

So, the present at-the-money $460 put had extra time to expiration (97 days versus 91 days) which ought to theoretically make it costlier. It was additionally barely much less out-of-the cash ($0.20 in comparison with $1.43) which ought to make it costlier. Plus, the SPY was greater priced by practically 34 factors which ought to make the worth of the comparative put greater priced as nicely.

However, IV has been hammered to the bottom ranges of the yr. In our instance, the places fell from over 18 to underneath 13 IV. This makes choice costs less expensive. To place it in proportion perspective, the price of the places fell from over 3% in October to only over 2% now.

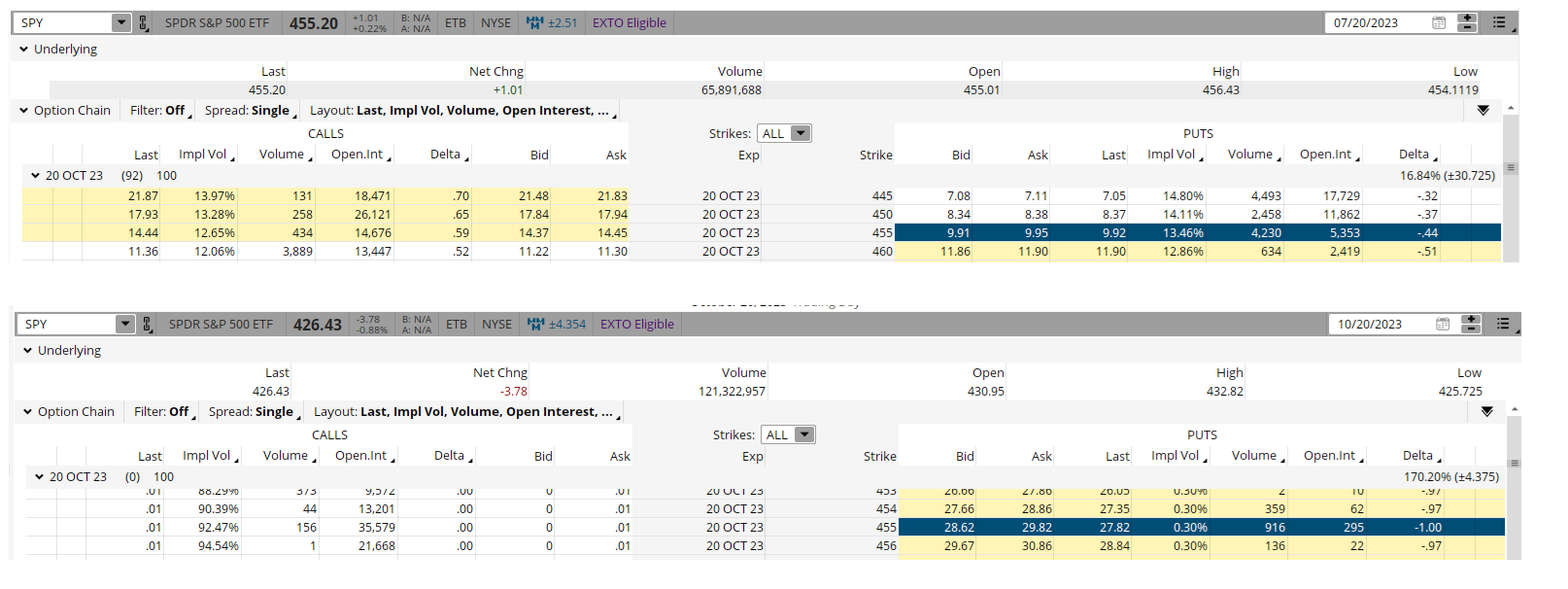

When you had purchased the same at-the-money places final time SPY was this virtually this excessive and VIX was virtually this this low in late July, you’d have been rewarded very properly as proven within the choice montages under.

The at-the-money October $455 places with 92 DTE might have been purchased for just below $10 on 7/20. These similar places closed on October expiration at just below $30. This equates to a 200% return in three months.

Actually, not all trades will work out this nicely and even this profitably-if profitably in any respect. That is buying and selling in any case.

However utilizing the POWR Choices strategy can put the chances in your favor. And on the finish of the day, buying and selling is all about chance, not certainty.

POWR Choices

What To Do Subsequent?

When you’re in search of one of the best choices trades for at present’s market, you need to take a look at our newest presentation Learn how to Commerce Choices with the POWR Scores. Right here we present you find out how to constantly discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you need to be taught extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Learn how to Commerce Choices with the POWR Scores

All of the Finest!

Tim Biggam

Editor, POWR Choices E-newsletter

SPY shares closed at $460.20 on Friday, up $1.97 (+0.43%). Yr-to-date, SPY has gained 21.67%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Dwell”. His overriding ardour is to make the advanced world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer.

Tim is the editor of the POWR Choices e-newsletter. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up Valuations, Velocity, and VIX Level To A Probabilistic Pullback In S&P 500 (SPY) appeared first on StockNews.com

[ad_2]