[ad_1]

Fast Information About Automobile Costs

- In November 2023, common new automotive transactions had been about 23% increased than the identical month three years in the past when no finish was in sight for the pandemic.

- Nevertheless, common transaction costs are flat in contrast with final 12 months.

- Producer incentives averaged about $2,500 in November. Incentives are up 136% from this time final 12 months.

- You possibly can simply discover a new Jeep, Infiniti, Ram, or Volvo, although not essentially a Toyota, Honda, Lexus, or Kia.

Within the final a number of years, automotive consumers have grown accustomed to paying greater than the producer’s prompt retail worth (MSRP). They watched automotive costs steadily rise, with no sign of ending. It left many patrons scratching their heads, and the query our specialists get most is, “When will new automotive costs drop?”

We will inform you that new automobile worth inflation has virtually disappeared this 12 months. That’s nice information on its face. Nevertheless, automotive costs have elevated exponentially within the final three years. Now, the latest United Auto Staff strike threatens stock and prices once more.

On this story, we’ll clarify how you can navigate automotive shopping for in order that when you’re available in the market to buy a automobile, you’ll be geared up with one of the best data from our specialists. We dig deeper to reply considerations about automotive costs dropping.

What Drives New Automobile Costs?

In keeping with Kelley Blue E-book information, new automotive common transaction costs (ATP) stayed flat month-over-month in November at $48,247. In keeping with Cox Automotive analysts, new automobile transaction costs fell greater than 1.5% year-over-year as downward worth stress continues to favor patrons available in the market.

“Whereas customers could really feel some aid in automobile costs and incentives as we shut out 2023, automakers and sellers are feeling the outcomes of the downward worth stress,” stated Rebecca Rydzewski, analysis supervisor at Cox Automotive, the mum or dad firm of Kelley Blue E-book. “The newest vendor sentiment survey by Cox Automotive clearly signifies that sellers are seeing income contract as stock ranges return to regular, and incentives are turned as much as assist stimulate gross sales.”

Producer incentives elevated to a median of $2,500 in November, up 136% from a 12 months in the past. Extra on that in a bit.

Common transaction costs stay about 23% increased than in November 2020 because the realities of the COVID-19 pandemic appeared endless. At the moment, common transaction costs for brand spanking new automobiles had been $39,259.

Automobile Pricing Breakdown

- Non-luxury automobile costs: In November, automotive patrons paid a median transaction worth of $44,417. General, costs have held regular since January.

- Luxurious automobile costs: The common transaction worth was $63,235 for luxurious automobiles. Luxurious automobiles make up about 20% of complete automobile gross sales. Luxurious costs dropped by almost 7.5% year-over-year.

- Electrical automobile costs: The common transaction for a brand new electrical automotive is $52,345, down from about $65,000 a 12 months in the past. Tesla common transaction costs dropped almost 21% in comparison with November 2022.

“In latest months, worth parity between EVs and ICE has virtually appeared potential,” stated Stephanie Valdez-Streaty, director of strategic planning at Cox Automotive. “It’s a difficult measure with loads of variables, however newer merchandise and better reductions have introduced down common EV costs, even earlier than potential tax incentives. A 12 months in the past, the EV premium was greater than 30%. In the present day, it’s lower than 10%.”

These elements usually have an effect on new automotive costs:

- Stock availability

- Producer incentives

- Seller reductions

- Commerce-in automobile worth

All 4 of these elements skilled main disruptions up to now a number of years.

New Automobile Stock Replace

Dealerships measure their shares of recent vehicles to promote in a measurement referred to as “days of stock” — how lengthy it will take them to promote out of recent automobiles at at the moment’s gross sales tempo if the automaker stopped constructing new ones. Final 12 months, inventories fell to only one week. By the beginning of December, many manufacturers’ inventories had been up 57% from a 12 months in the past. That’s the best stock degree since early spring 2021. Nevertheless, just a few carmakers, like Toyota, Honda, Lexus, and Kia, can’t fill all automotive orders as a result of an absence of stock. Days’ provide calculations embody automobiles in vendor stock and in transit or pipeline.

Earlier than the United Auto Staff strike in September, home automotive manufacturers started including extra automobiles to stock. In contrast, stock fell to report lows throughout the top of the pandemic and worldwide microchip scarcity. With out sufficient essential microchips, which management every little thing from engine timing to navigation methods, automakers couldn’t construct vehicles as quick as they wished. Regardless of near-normal automotive stock for many carmakers, the lingering results of provide chain points and the chip scarcity proceed for some carmakers and specific fashions.

In 2022, producers like Ford started rethinking inventories for the lengthy haul regardless of the resolving chip scarcity.

Which Automakers Have the Most Automobiles?

Cox Automotive’s evaluation of its vAuto new and used automotive dealership administration software program information exhibits that manufacturers like Lincoln, Chrysler, Jaguar, Alfa Romeo, Dodge, and Fiat provide days’ provide that’s effectively above twice the trade common. In distinction, stock ranges nonetheless sit effectively below regular for Toyota, Honda, Lexus, Kia, Land Rover, and Subaru.

RELATED: Is Now the Time to Purchase, Promote, or Commerce-In a Automobile?

General, the auto trade stocked 71 days’ value of automobiles initially of December. That’s thought of a traditional provide of stock by historic requirements, and it’s additionally the best since early spring 2021. By comparability, automakers stocked a wholesome 86-day provide of automobiles throughout the summer time of 2019 earlier than the pandemic.

Automobile Incentives Maintain Regular

Carmakers used extra incentives to draw patrons than at any level up to now two years. In November, they remained unchanged. In keeping with Kelley Blue E-book’s analysts, carmakers spent 5.2% of the common transaction worth on incentives meant to maneuver automobiles. Incentives averaged about $2,500. Nonetheless, these are thought of traditionally low in comparison with fall 2020, when incentives had been about 20% of the common transaction worth.

When automakers construct up an oversupply of vehicles, they low cost the automobiles to get them off vendor heaps. For the previous a number of years, carmakers and dealerships confirmed no glut of vehicles to promote, they usually barely discounted. Now, provide is bulking up once more, partly due to increased rates of interest on automotive loans.

In keeping with our evaluation, the posh automotive phase provided the most important incentives by a lot of 2023. In November, luxurious model incentives reached 5.8% in contrast with non-luxury incentives at 5%.

Store Round for the Finest Supply on Your Commerce-In

Commerce-in worth is one other issue driving automotive costs. An absence of used automobile inventory is pushing costs increased, giving inventory to the concept that shopping for a brand new automobile is cheaper than buying a more moderen mannequin used one. In that vein, it’s a good time to commerce in your automobile. Automakers scaled again manufacturing for a number of years after the 2008 recession. That leaves the higher-mileage, older vehicles sellers promote for lower than $20,000 significantly onerous to search out now.

Sellers worth your trade-in partly primarily based on what they want in inventory. They’re extra prone to provide an excellent deal to patrons on a automotive fewer persons are in search of at the moment. Automobile sellers are oversupplied with comparatively costly used vehicles.

In different phrases, customers buying and selling in a 2018 Honda Civic shall be a lot happier with the commerce appraisal than these buying and selling in a 2021 Jeep Grand Cherokee.

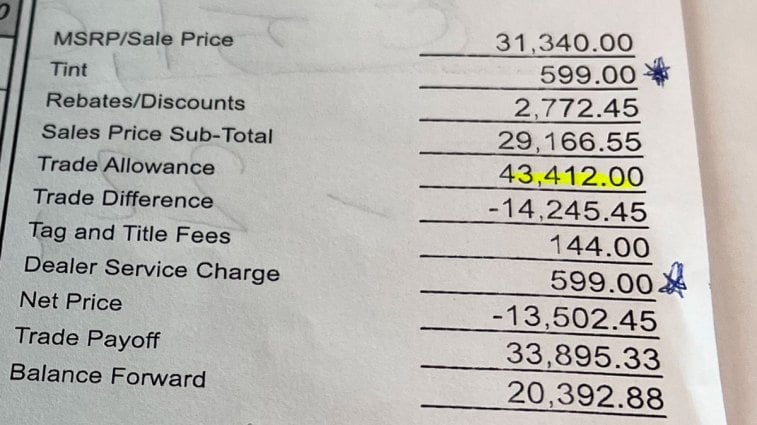

Consumers also needs to be ready to store their trade-in round. It’s barely extra difficult to drag off, however promoting your previous automotive to at least one dealership could make sense, and shopping for your new automotive from a special one if the ultimate bill numbers work out higher. Use the Kelley Blue E-book Instantaneous Money Supply software to buy your trade-in automobile at close by dealerships. If you let the offers come to you, you may choose one of the best trade-in provide to your state of affairs.

PRO TIP: I lately used the Instantaneous Money Supply software to see what I might get for a household automobile whereas sitting in a dealership making an attempt to seal a deal for a subcompact SUV. The provides began flowing in as excessive as $50,000 for our 2021 Ford F-150 Lariat with a hybrid powertrain with low miles of 13,000 and no accident historical past. On the dealership the place I used to be making an attempt to make the deal, they provided $43,412. With a Kelley Blue E-book worth of $50,196, I attempted to make use of the opposite provides as leverage, however the dealership wouldn’t budge. So, I walked away from the dealership with the low-ball provide and went to a different with one of the best provide.

New Automobile Costs Proceed to Drop

So, when will new automotive costs go approach down? For some manufacturers and a few dealerships, costs started dropping. With different manufacturers, like Toyota, Honda, and Kia, consumers have to be ready to hunt and pay extra for tougher-to-find fashions. In latest months, hard-to-find vehicles and SUVs embody the brand new Toyota Grand Highlander, Honda CR-V and its hybrid model, Toyota Camry, Toyota Corolla, Honda Civic, and Toyota RAV4.

Some Automobiles Nonetheless Promote at Markup Costs

Whereas some carmakers and sellers with loads of stock present incentives, others are nonetheless in brief provide. It means some dealerships are nonetheless marking up choose automobiles.

In keeping with Markups.org, some Honda, Toyota, Ford, and Kia fashions promote above MSRP in locations like California, Florida, and Texas. In Georgia, a Hyundai Tucson was marked up at a dealership within the Atlanta space.

PRO TIP: Since buying lately for a automobile, I discovered markups various at dealerships that bought automobiles comparable to Kia and Hyundai. One vendor charged $599, and one other $699. One other referred to as them “doc charges.” Earlier than you store, perceive how a lot these doc submitting charges price for automotive tax, tag, and title in your state before you purchase a automobile. These are pure markups or revenue facilities for the dealership. One other markup on an bill could say “paint and material safety” or “window tint.” Earlier than you signal something, it’s clever to ask the salesperson to take away these charges in the event that they actually need to promote you the automotive.

What to Count on: Wanting Forward

However what when you desperately need a common automotive that’s in low provide? Then, it’s time to check your endurance. Federal Reserve rate of interest hikes used earlier this 12 months to rein in inflation nonetheless make it tougher for customers to purchase vehicles. In keeping with Cox Automotive analysis, the everyday new automotive mortgage rate of interest declined in December to a median of 9.6%. That’s down from about 10% in October. Meaning automobile affordability is bettering, even when slowly. Moreover, cooling inflation leaves the door open for rate of interest cuts within the close to future.

For now, automotive consumers should stay versatile. Discovering a low worth on a brand new automotive is feasible. It simply will not be the automotive you thought you’d purchase. Or it’s possible you’ll want to go to a smaller city outdoors the massive metropolis the place there’s much less competitors.

Editor’s Notice: This text has been up to date for accuracy because it was initially revealed. Sean Tucker contributed to this report.

Associated Articles for Automobile Shopping for:

[ad_2]